GOAL

Meet the requirements to offer local accounts to users in Germany

KEY PROBLEM

Revolut users in Germany have a Lithuanian bank account and IBAN (LT).

This shouldn’t present any issues as it is a EU bank account, but it’s still considered not preferable and even unreliable by some users. Furthermore, some specific payments can only be done with a German bank account.

SOLUTION

Meet German requirements to be able to offer users based in Germany local accounts and IBANs (DE).

This makes it more likely for them to transition into using Revolut as their primary bank account.

USER STORIES

I just moved to Germany for a job and my employer is asking me for a German IBAN. I’ve heard good things about Revolut, but since they don’t offer German IBANs I’ll have to go for another option.

I like Revolut, it’s convenient and easy to use. I always use it at restaurants and when traveling. Unfortunately, I still rely on my Deutsche Bank account to pay rent, so I receive my salary there.

MAIN CHALLENGE

Meet Germany’s identity verification requirements.

To open a German bank account, users need to verify their identity either: in person, through another bank account in their name or by video call with an agent.

We drafted versions for these two verification methods to do an initial round of user testing (guided interviews) and came up with these conclusions

Bank verification

✅ Can be done any time of the day

✅ We can reuse an existing Revolut process

❌ Requires another German bank account

❌ Security concerns, trust isn't built yet

Live call with an agent

✅ No need for another German bank account

✅ Covers all 3 steps of the verification

❌ Cannot be done outside of business hours

❌ Higher cost (5,10€/ user instead of 0,55€)

Offering both options strategically

OPTION A

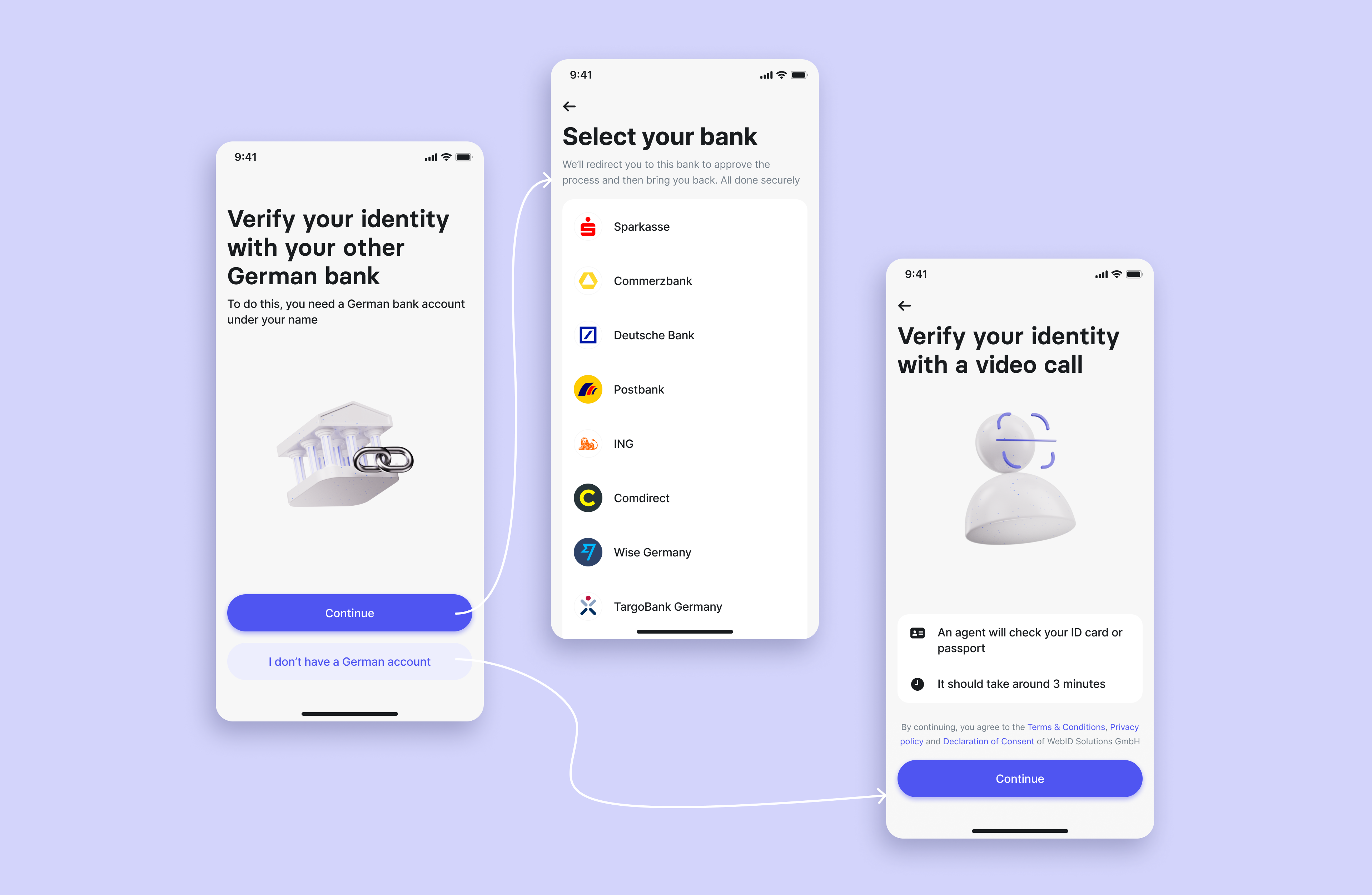

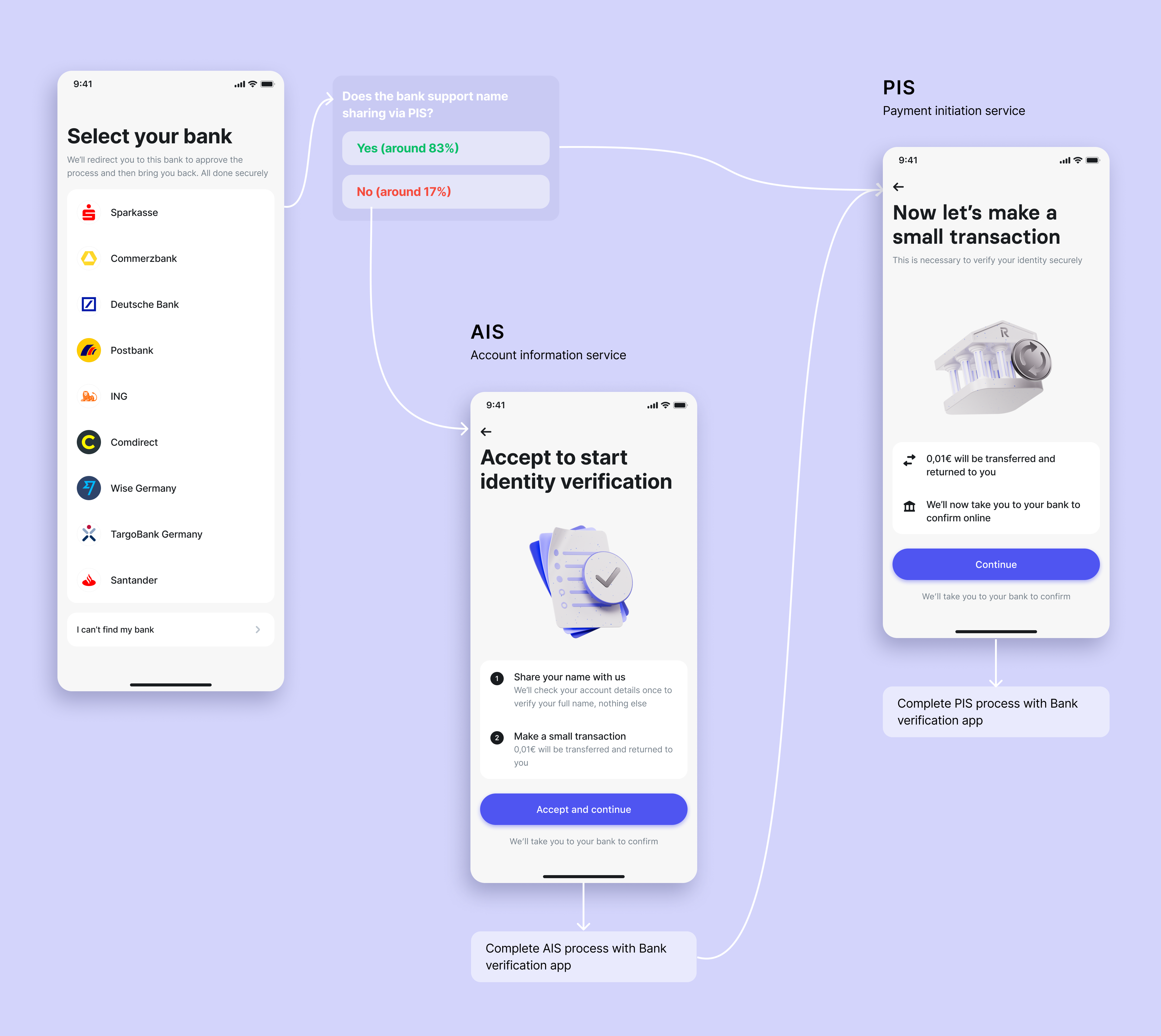

Bank verification

Reusing an internal process but adapting it for an optimal solution. Revolut already offers account linking. This allows users to see their transactions from multiple bank accounts in one place and transfer money between them easily.

The technology used for this process can be reused for identity verification.

How does it work?

Through name matching. If the name of the account holder matches what they submit to Revolut, this person already went through identity verification (either in person or through video call) to open this initial bank account.

Adjustments

- New intro screens for context

- Reducing permissions to only what is relevant and adapting terms accordingly (new terms screen)

- Covering all possible scenarios: success and errors

ERRORS & SUCCESS

OPTION B

Video call with an agent

Seamlessly integrating the technology of an external company (Web ID) without compromising the look and feel of Revolut.

What happens during the video call?

- User gives the agent the identification number

- User follows a set of instructions, including showing an identity document

- User enters the OTP they receive by SMS after 2 is completed

Adaptation of Web ID’s solution

- Simplify Web ID’s standard verification flow as much as possible for an optimised UX

- Create a new interface for the call that follows Revolut’s guidelines

- Collaborate with Web ID to implement it

- Implementing it with an SDK to avoid increasing the size of the app.Still, we keep the user in the Revolut app throughout the whole process

ERRORS & SUCCESS

COMPLETE AFTER SIGN UP

OUTCOME

Both identity verification methods were implemented, extensively tested and finally launched on March 2024

This, along with other initiatives, allowed Revolut to earn a full banking license in Germany.

INMEDIATE IMPACT

Now, Revolut users in Germany can benefit from...

- Having their money insured by German authorities. Germany insures up to 100.000€

- A German IBAN (DE). No more IBAN discrimination!

- A modern, paper-free and hassle-free bank account that they can use in their preferred language but is still German.

EXPECTED IMPACT

More users will choose to receive their salary to their Revolut accounts and eventually make Revolut their primary bank.

Team

Product Owner - Alexander Grishchenko

Product Designer - Amelia Román Mikkilä